Hub for Quantum Financial Tech

Alright, let's dissect this BlackRock situation. A $400 million Bitcoin transfer to Coinbase Prime isn't exactly pocket change, especially when it coincides with IBIT (BlackRock's Bitcoin ETF) experiencing its worst outflow month on record—over $2 billion. The timing is... unfortunate.

Exodus Alert: BlackRock's $2 Billion Bitcoin Bailout

Decoding the Data Dump

The first red flag is the sheer size of the outflow. Two billion dollars in a single month? That's not just a minor correction; that's a significant chunk of capital heading for the exits. Arkham data shows BlackRock's wallet value plummeting by over 30% in recent weeks, a drop from $117 billion to $78.4 billion. Now, some might argue that this is simply market volatility, but a 30% drop suggests more than just a few nervous retail investors.

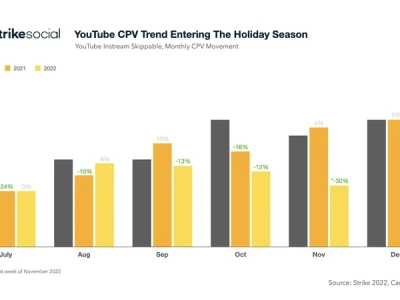

This is where the debate begins. VanEck's Matthew Sigel points to tightening US liquidity and AI-capex fears as the culprits. Essentially, he's saying the macro environment is squeezing Bitcoin. Makes sense on the surface, but I'm always wary of overly simplistic explanations. Cathie Wood, on the other hand, calls it a temporary squeeze, citing a 123% surge in Palantir's US commercial business as proof that enterprise adoption is still strong. (I'd argue Palantir is a unique case, not necessarily indicative of broader crypto adoption.)

Here's the critical question: are these outflows a sign of institutional investors losing faith in Bitcoin, or are they simply rebalancing their portfolios in response to broader market conditions? Eric Balchunas attempts to downplay the outflows, arguing that 97% of investors are "sticking around." But let's be clear: 3% of AUM leaving *is* a lot of money. It's like saying 3% of your blood volume isn't a big deal – tell that to someone with acute blood loss.

BlackRock's Bitcoin Transfer: Preparing for the Worst?

The Liquidity Squeeze: Real or Imagined?

The transfer of 4,471 BTC to Coinbase Prime is particularly interesting. What's BlackRock planning? Are they anticipating further outflows and preparing to meet redemption requests? Or are they positioning themselves for a potential market downturn, looking to buy back Bitcoin at lower prices? The article mentions that analysts like Crypto Rover believe this move could "exacerbate selling." I'm inclined to agree; a large player like BlackRock moving that much Bitcoin can easily spook the market. BlackRock’s $400M Bitcoin Entry Sparks Debate Over Market Liquidity

I've looked at hundreds of these filings, and this particular combination of outflow size and BTC transfer is unusual. It suggests a level of concern that isn't being fully articulated in the headlines. It's like a poker player who suddenly starts sweating and fidgeting; the data points to something more than just a bad hand.

Then there’s the curious case of the Indian Rupee. According to a separate report, the USD is pushing the Rupee to lifetime lows, despite weak signals from the DXY index. Foreign investors have withdrawn $16.5 billion from the Indian stock market in 2025. What does this have to do with BlackRock? It’s a symptom of the same disease: global liquidity concerns and a flight to safety. USD Currency Dominance: US Dollar Pushes the Rupee To a Lifetime Low

Is This the Beginning of the End?

The numbers paint a concerning picture. BlackRock's IBIT is facing significant headwinds, and the broader market is showing signs of stress. While it's too early to declare the end of IBIT or Bitcoin, this situation demands close scrutiny. The next few weeks will be crucial in determining whether this is a temporary blip or the start of a more sustained downturn. I'll be watching the outflow numbers closely, and any further large BTC transfers.

The ETF Honeymoon Is Over