Hub for Quantum Financial Tech

Okay, folks, buckle up. Because what's happening in DeFi right now isn't a sign of weakness, it's a sign of something *far* more interesting: evolution. We're seeing a "flight to safety," sure, but that's just the chrysalis stage before the butterfly emerges.

DeFi's Not Dead, It's Just Getting Started

The Great DeFi Rethink

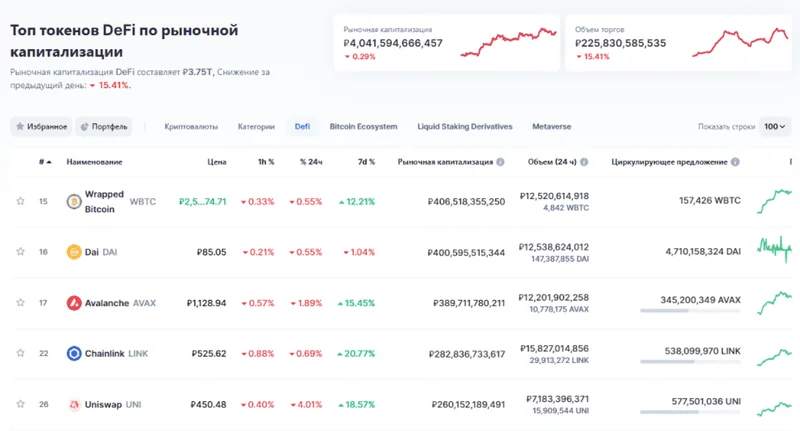

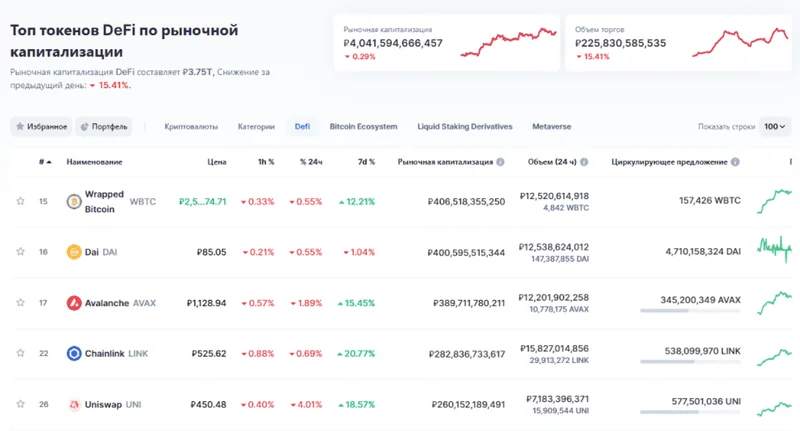

The latest reports are showing a definite shift in investor sentiment post the October 10th crash. Only a tiny fraction of leading DeFi tokens are showing positive year-to-date numbers. Ouch. And yeah, the sector's down a hefty chunk this quarter. But here's the thing: that doesn't mean DeFi is dead. It means it's *adapting*.

Beyond Hype: Substance is the New Safe Haven

Flight to Safety and Demand for Substance

Investors are flocking to what they perceive as safer harbors—tokens with buyback programs, for instance, or projects with solid, demonstrable catalysts. Think HYPE and CAKE on the buyback front, or MORPHO and SYRUP showing resilience thanks to their fundamentals. What does this tell us? It's simple: investors are getting smarter, demanding more than just hype. They want substance, real value, and projects that can weather the storms.

Hidden Gems in the DeFi Galaxy: Bargains Abound!

Divergence in Valuation Landscape

We're also seeing a fascinating divergence in the valuation landscape. Some DeFi subsectors are getting cheaper relative to their activity, while others are becoming more expensive. Spot and perpetual decentralized exchanges (DEXes) are seeing their price-to-sales multiples compress, which might seem bad at first glance. But consider this: it means there are potential bargains to be found, projects that are undervalued relative to their actual performance. The Striking Dichotomy in DeFi Tokens Post 10

Lending and Yield Opportunities

Lending and yield names, on the other hand, are seeing multiples *increase*, even as prices decline. This suggests that investors see lending as a more stable, "sticky" activity in a downturn. They're seeking yield opportunities as they exit riskier assets, and lending platforms are benefiting.

Survival of the Fittest: Building a Stronger Crypto Future

Natural Selection and Market Evolution

This is all part of the natural selection process in any emerging market. The weak die off, the strong adapt, and the entire ecosystem becomes more robust as a result. As Martin Gaspar from FalconX puts it, these trends reveal potential opportunities from dislocations in the wake of the crash.

DeFi's Coming of Age: Beyond Speculation, Towards Substance?

The Future of DeFi Valuations

The big question is, will these changes mark the beginning of a broader shift in DeFi valuations, or will they revert over time? Are we seeing a fundamental realignment of investor expectations, or just a temporary blip? I think it's the former. I think we're witnessing the birth of a more mature, discerning DeFi market, one that values sustainability and real-world utility over pure speculation. What do you think?

Historical Analogy: The Dot-Com Bubble

A Quick Historical Analogy: Remember the dot-com bubble? It burst, hard. But did that mean the internet was a failure? Of course not! It meant that the initial hype had outstripped reality, and that a period of consolidation and refinement was necessary. The same is true for DeFi. We're past the initial frenzy, and now it's time to build something lasting.

New Coins: Fads or the Future of Finance?

New Coins and Fintech Integrations

And what about the new coins popping up? Bitcoin Hyper (HYPER), Maxi Doge (MAXI), PEPENODE, Ethena (ENA)... the list goes on. Are they just fleeting fads, or do they represent something more? Some, like Bitcoin Hyper, aim to solve real problems, like Bitcoin's scalability issues, by integrating with Solana's speed. Others, like Maxi Doge, are pure meme coins, banking on hype and community. The key, as always, is to do your research and separate the wheat from the chaff. 10 New Crypto Coins to Invest in 2025: Top New Cryptocurrencies

DeFi Bridges: Fintech Integration Sparks Lending Revolution

Fintech and Prediction Market Growth

One thing that's particularly exciting is the potential for fintech integrations to drive growth in the lending sector. AAVE's upcoming high-yield savings account and MORPHO's expansion of its Coinbase integration are just two examples of this trend. It’s like DeFi is finally starting to talk to the "real world," bridging the gap between decentralized finance and traditional financial systems.

And it's not just about lending. Prediction markets are seeing record volumes lately, suggesting that investors are looking for new ways to profit from volatility and uncertainty. The cheapening in the DEX sector may be warranted on lower growth expectations, but it also creates opportunities for innovative new platforms to emerge and disrupt the status quo.

Innovation with Responsibility: A New Financial Ethos

Personal Reaction and Ethical Considerations

[Personal Reaction] When I see this kind of innovation, this willingness to experiment and adapt, it reminds me why I got into this field in the first place. It's not just about making money; it's about building a better, more accessible, and more equitable financial system for everyone.

The Ethical Question: All this innovation comes with responsibility. As we build these new financial systems, we need to make sure they're fair, transparent, and resistant to manipulation. We need to think about the potential risks and unintended consequences, and we need to build in safeguards to protect users.

Finance Reimagined: A Leap, Not a Retreat

The Future of Finance

What does this all mean for us? It means that the future of finance is being written right now, and we all have a role to play in shaping it. It means that the "flight to safety" isn't a retreat, it's a strategic repositioning, a regrouping before the next big leap forward. And it means that the best is yet to come.

DeFi's Evolution: Learning, Adapting, and Rising

DeFi: The Phoenix Rises

DeFi: The Phoenix Rises

The DeFi space isn't collapsing, it's evolving. It's learning from its mistakes, adapting to new challenges, and building a more resilient foundation for the future. The "flight to safety" is just a temporary detour on the road to a more decentralized, accessible, and innovative financial system.