Hub for Quantum Financial Tech

DeFi's Winter Thaw: How Bitcoin's Resilience Signals a New Era of Crypto Trust

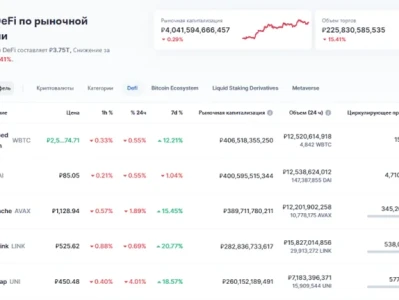

Okay, folks, let's be honest: the crypto world has felt a bit like a rollercoaster lately, hasn't it? We've seen some stomach-churning dips, especially in the DeFi space. I mean, just last week, the numbers were flashing red across the board. Only a tiny fraction of the top DeFi tokens were showing any positive movement this year, and the whole sector was down nearly 40% in just a few months. Ouch.

And then there's Bitcoin. It shed a third of its value in under two months. The Bitcoin Trend Indicator—something I always keep a close eye on—signaled a "Significant Downtrend" for weeks. It’s enough to make even the most seasoned investor sweat a little, or maybe a lot.

But here's the thing about winters: they don't last forever. In fact, they're often followed by the most spectacular blooms. And I think, *I hope*, we're starting to see the first signs of that thaw in the crypto landscape, a shift towards a more resilient and, dare I say, *trustworthy* future.

Winter's Thaw: Smart Money Bets on Crypto's Future

The Green Shoots of Recovery

What makes me so optimistic? Well, for starters, look at how the market is reacting. Even amidst the downturn, we're seeing smart money making moves. Big wallets that likely sold off near Bitcoin's peak above $100,000 are now buying back in, 20% lower. That suggests a belief in the long-term value, doesn't it?

And it's not just blind faith. We're also seeing a flight to quality, a search for stability. Investors are gravitating towards "buyback" names, those projects with solid fundamentals and proven track records. Plus, there's growing interest in lending platforms, which are seen as more resilient during market turbulence.

Think of it like this: when a storm hits, you want to be in a well-built house, not a flimsy shack. And right now, investors are reinforcing their foundations, choosing projects that can weather the storm.

One thing that *really* caught my attention is the activity around HYPE's "perps on anything" markets. These markets are seeing record volumes, suggesting that people are actively using crypto to hedge their positions and manage risk. This is huge! It shows that the market is maturing, developing sophisticated tools to navigate volatility. We are seeing more developed put skew in Bitcoin, a healthy sign of market maturation.

There's also El Salvador, which has doubled down on its Bitcoin strategy, buying up even more BTC during the dip. Now, I know El Salvador's crypto experiment has been controversial, but you have to admire the country's conviction. Their total holdings are now close to 7,500 BTC.

And while some DeFi projects are struggling, others are thriving. Certain DEXes (decentralized exchanges)—like CRV, RUNE, and CAKE—have seen their fees increase over the past few months. This shows that people are still using these platforms, even when the overall market is down.

It's like how Amazon kept building during the dot-com bust. While everyone else was panicking, they were laying the groundwork for future dominance.

I have to admit, though, I do worry about the impact of the October 10th crash on the DeFi sector. It's clear that some projects are still feeling the pain. Crypto Long & Short: The Striking Dichotomy in DeFi Tokens Post 10/10 - CoinDesk But I also believe that this shakeout is ultimately healthy. It's forcing projects to become more efficient, more innovative, and more focused on delivering real value to users.

And let's not forget about the big players who are still investing in the space. BlackRock, for example, has registered the iShares Staked Ethereum Trust, signaling its intention to launch a yield-generating ether ETF. Mastercard is expanding its Crypto Credential system to self-custody wallets, using Polygon's blockchain. These are not small moves. These are signs that institutional adoption is continuing, even during the downturn.

What does this all mean? It means that the crypto winter, while painful, is also an opportunity. It's a chance for the industry to mature, to consolidate, and to build a stronger foundation for the future.

Crypto Winter Thawing: A Spring of Innovation Awaits!

Crypto's Spring is Just Around the Corner

I know it's easy to get discouraged when you see red across your portfolio. But I truly believe that the crypto market is on the cusp of a new era. An era of greater stability, greater trust, and greater innovation.

We are seeing strong signals that the market is bouncing back. It's time to buckle up, stay informed, and prepare for the next wave of growth. The journey may be bumpy, but the destination is worth it. Let's ride this wave together.

Prev

OECD: World Economy 'Resilient' to Tariffs: What They're *Really* Selling You

Published on2025-12-03 Views2 Comments0

Prev

OECD: World Economy 'Resilient' to Tariffs: What They're *Really* Selling You

Published on2025-12-03 Views2 Comments0

Next

5 Things Before Open: The Data Analysts Miss (Thread)

Published on2025-12-05 Views1 Comments0

Next

5 Things Before Open: The Data Analysts Miss (Thread)

Published on2025-12-05 Views1 Comments0

Why DeFi's Crash Paved Way for 2025 Opportunities - Deep Dive Discussion

Views1 Comments0

DeFi Token Performance &

Investor Trends Post-October Crash | 2025 Analysis

Why DeFi's Crash Paved Way for 2025 Opportunities - Deep Dive Discussion

Views1 Comments0

DeFi Token Performance &

Investor Trends Post-October Crash | 2025 Analysis